It will be held. Alliance Bank Hire Purchase.

What Happens To The Car Loan If The Applicant Passes Away Paysense Blog

The IC of the person in charge of handling the deceaseds matters.

. But even though getting a bank loan may be necessary to life and living that doesnt mean that one should go in without proper planning. Procedure To Appy Loan To Buy A Car in Malaysia is a bit complicated. In most cases a rebate will be given when a car loan in Malaysia is settled early.

Are you still servicing your hire purchase loan for the car. At JPJ youll need to have the following things. Use this calculator to find out your settlement and rebate amount if you want to pay off your car loan or personal loan early.

The total amount that you must pay if you regularly pay for 9 years are 42K base on car interest loan at 4 annually. You must have Driving License Pay slip and Guarantor to get better interest rate for car loan in Malaysia. Loan Tenure Repayments and Early Settlement.

Early settlement penalty RM0. For Malaysian you got save for 4K is a big money yahh. In this example you select Maybank Hire Purchase to finance your car purchase.

How much time do you need to pay off this loan. For the purchase of a new car Maybank is offering up to 90 margin of finance with you covering the remaining 10. Do you know if TODAY you want to pay full settlement you only pay for 20K instead of 24K.

So how this calculation has been made. He is staying very far away hence I hope you could tell me the easiest way we can settle the whole process after the loan is approved without travelling too many times. Car Loan Settlement Calculator Tips Aka car loan redemption calculator.

What will I get after processing. Car loan settlement calculator estimates your total amount payable and savings for early repayment on your vehicle bought through hire purchase. Without taking a personal loan from the bank buying a house or securing higher education might be a far-off dream.

Unless you have RM 60000 lying around to pay the bank in full used car dealerships are your next option because they would have the option to settle off your loan in full. Here are things you should know about settling loans-. But you can settle your car loan early and earn interest from FD and rebate from bank by Full Settlement I financed RM20000 to buy a Proton Saga in 1999.

If yes the bank can claim rights to the car and youll need to settle the loan first before you can transfer. Bank Name Car Loan Interest Rates. To illustrate further see the car loan.

Using our car personal loan calculato r the early settlement amounts to RM34684 with a total rebate of RM4209. AmBank Arif Hire Purchase-i. 18 20 depending on loan package Maximum Age.

After you complete the installation of the car loan you will be contacted by the bank to collect the Settlement Release Letter to show that you have completed all your payments Also to collect the vehicle registration card if you have never collect before. He is buying by bank loan. Early settlements of your car loan in Malaysia can save you money but this depends on the loan type youve chosen.

If im not mistaken will take about 1 week to process early settlementpayoff of the HP. - If its RM65000 - an approved loan is RM59900. I am going to sell my car already found a buyer and price has been agreed.

I signed up six years repayment term and paid RM404 as monthly installment. If you did not get it then contact the bank to locate the letter. The official JPJ chop supposedly to proof there is no loan attached to the car.

A car loan settlement calculator helps you to calculate the amount you will need to pay to settle. Pre-repossession notice A pre-repossession notice Fourth Schedule will be served on you personally delivered or send by registered mail to your last known address and your guarantor. In Malaysia you may take out a car loan for a minimum of 1 year to a maximum of 9 years.

If its RM55000 an approved loan is RM55000. Applicable with the formula below. Settlement of delivery is done by 1130 Malaysian time by stock transfer via the CSD to the broker.

The deceaseds original death certificate. Once the application and documents are submitted it is up to the bank to decide on the approval of your car loan. Hi Fiona by far this is the best information to sell a car in Malaysia.

Legal permit to repossess your car. Rebate Cr r1t t1 C Interest payable for the whole Tenure. The interest rate is priced at 340 annually and you can extend the repayment period for as long as 9 years.

Charged at 3 on the total balance outstanding principal interest subject to a minimum of RM300 whichever is higher. Personal Loan Settlement Calculator Malaysia. The repossession order issued by your bank or the court order.

You can check the latest plate number. Based on our own calculation using cash flow method the effective interest per year saved due to early settlement is 433. The interest for car loan was 76 at that time very high but lower than few months before I took the loan.

Equivalent Mortgage FD Interest Rate saved by full settlement is. Below is a summarised diagram of a typical car loan application process in Malaysia. The custodian receives an inter-bank payment for delivery trades by 1600 Malaysian time.

For example to buy a car with a net worth of RM59993 the officer has a maximum loan eligibility of. With the exception of boat or bike loans the loan amount should be rounded to the lower hundred ringgit amount. JPJ K3A form this is different from the K3 form which is for voluntary transfers.

Well this is where loan calculator tools come in handy to help you run repayment simulations and assist in figuring out a suitable time-frame to settle the loan. You can ask your bank about the rebate amount. Check out our up-to-date Personal Loan comparison tool.

So you got save up 4k. 3 After processing I was told to go to JPJ Office and get a chop on the car grant original grant is with me. STEPS TO REPOSSESSION Step 1.

First get the car inspected by Puspakom and then head to JPJ. If you fall victim to the oppressive measures taken by the repossessors or if your rights have been wrongfully infringed during repossession make a complaint to the bank that repossessed the car. Most of the used car dealership would usually charge a processing fee that can go up to RM 5000 to cover.

To make it easier for you refer to your car seller about the Loan approval for hire purchace agreement and car registration. The vehicle is fully owned by you and youre free to do as you please with it. Hisher MyKad or IC.

Broker transfers shares via CSD to the custodian for good value by 1500 Malaysian time. Number of installment paid 30 months. 44 70 depending on loan package If youre looking for specific loan packages that fit your needs you should check out the vehicle financing options that Bank Muamalat offers.

To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application.

Aiya Bank Took My Car Repossessed What Can I Do

How To Sell Your Car With An Existing Loan

How To Sell Your Car With An Existing Loan

6 Ways To Reduce Your Mortgage Repayment Faster

The Steps To Clear A Lien On A Car Loan Uscdr

The Steps To Clear A Lien On A Car Loan Uscdr

Car Personal Loan Settlement Calculator

This Is How Banks Fooled You With The Rule Of 78

Car Loan Settlement Calculator Mypf My

Hong Leong Bank Car Loans Auto Loans Calculator Interest Rate

The Malaysia Type Of Car Loan Proton May 2022 Tax Holiday Rebate Rm7000 Interest Rate As Low As 2 8

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan General Rules Requirements Eligibility Amount Of Public Sector Home Financing

Do You Know About The Rule Of 78 Imposed On Early Settlement Of Loans The Star

This Is How Banks Fooled You With The Rule Of 78

Car Personal Loan Settlement Calculator

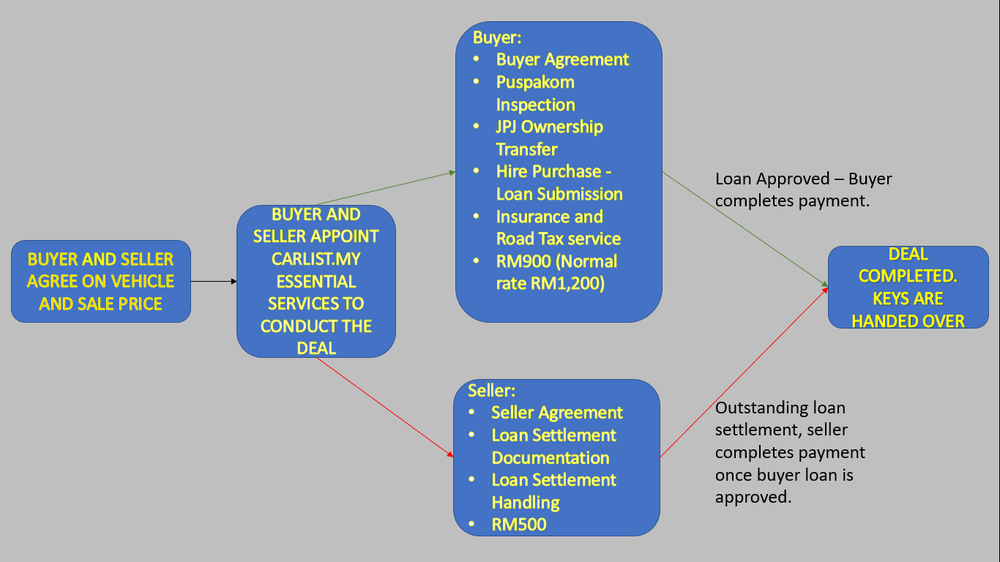

The Easiest And Cheapest Way To Sell Your Car If It Has An Existing Hire Purchase Loan 购买指南 Carlist My